Varo, a Neobank, announced this week that the FDIC approved their banking charter. This is a first for Neobanks, enabling them now to hold customer deposits and lend that money out.

You know, like a regular bank.

This will be a fascinating experiment, one that could make or break the thesis on the potential value of Neobanks.

To understand why, it’s worthwhile to explore the challenges Neobanks (Chime, Stash, etc…) face and how this charter potentially differentiates Varo.

The Problem With Neobanks

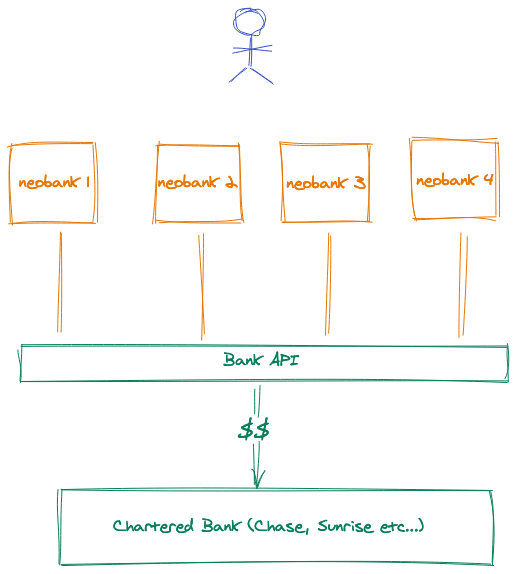

First, let’s understand what a Neobank actually is. You don’t deposit your money with a Neobank. Your money is actually held (and subsequently lent out) by a traditional bank.

It looks a little something like this.

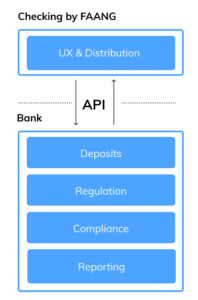

That API between what the Neobank controls and the deposit holding bank introduces a set of challenges. It means the Neobank:

- Can’t earn money by using the deposited funds to lend out at a near-zero cost of capital

- Is limited in their product development by the API’s available from the underlying bank (or infrastructure provider that sits in the middle).

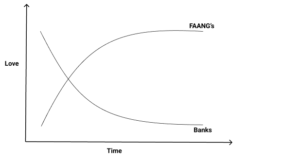

The bear argument for Neobanks is that they are novel UX layers and marketing channels, which can easily be replaced, to bring deposits in for the underlying bank.

On the bright side, Neobanks do not have the compliance overhead of holding customer’s money. The bull case treats Neobanks as modern finance companies with incentives aligned to their customers.

For example, Neobanks protect you from overdraft fees with warnings and quick loans because they make their money from a monthly SaaS fee as opposed to the penalty fee itself. A traditional bank has no incentive to offer the same protection, it just hurts their bottom line.

The Varo Bull Case

With their charter, Varo is betting that owning the entire stack, from UX to deposits, will enable them to:

- Build the tech stack that realizes the potential of relationship banking.

- Better anticipate, qualify, cross-sell and serve customers than banks today and at a lower cost of capital and less friction than other Neobanks.

- Offer API driven banking infrastructure that others can build on (note: this one is something I’d like to see, not what they’ve publicly stated)

Can Varo do this and challenge incumbent banks in scale and market cap? Maybe.

The charter gives them a unique weapon in their arsenal. Considering it has taken them almost 3 years to get the charter issued it doesn’t appear there will be any fast followers. And with it, we’ll finally see what the value of a fully digital bank is.

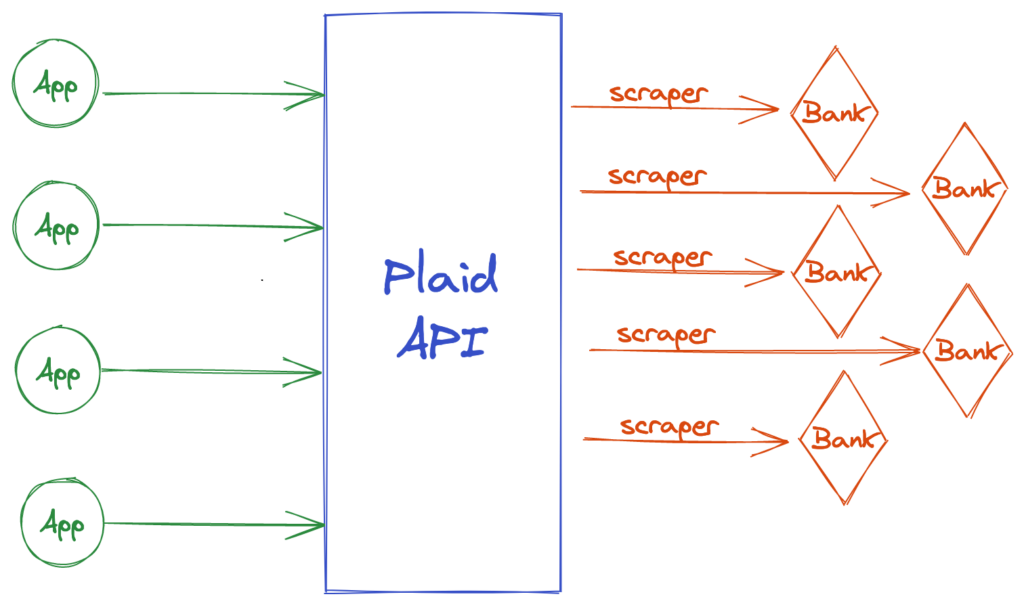

Emerging Fintech API’s makes it easier to build products like checking and lending today. The API from a bank for deposits separates the regulatory burden (i.e. the historical barrier to entry) from the UX and customer acquisition.

Emerging Fintech API’s makes it easier to build products like checking and lending today. The API from a bank for deposits separates the regulatory burden (i.e. the historical barrier to entry) from the UX and customer acquisition. The timing is also right.

The timing is also right.