If you’re building a bank today, you’re in luck. Much of what you need is available via API so you can skip the months of legwork to find bespoke banking and compliance partners.

You can start building on day 1.

Here’s a few of the things you can start building quickly by standing on the shoulders of g̵i̵a̵n̵t̵s giants-in-the-making.

KYC/AML

To offer most financial products you’ll kneed to abide by Know Your Customer (KYC) and Anti Money Laundering (AML) rules. This will involve asking the user for personal and financial information and verifying it’s authenticity. These providers automate much of the work required to verify the information collected.

- ID Verification — Is that picture of their passport or driver’s license they uploaded authentic and actually of them? Trulioo and Jumio will handle that check for both USA and international applicants.

- Accuracy & Watchlist Scans — Is the address they provided really theirs? Is their legal status free of flags for money laundering or international watchlists? Blockscore handles those checks via its API.

Account Inspection

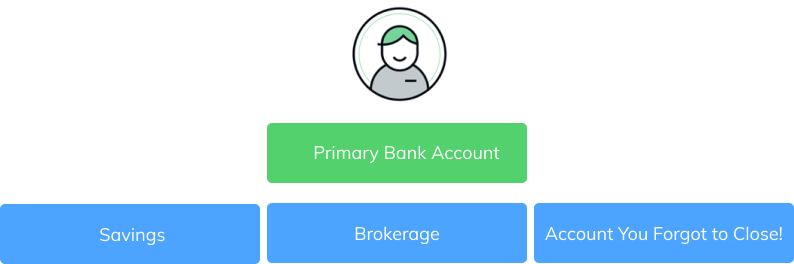

While onboarding the customer, you’ll often want to confirm and connect with financial accounts they own. Perhaps you’ll want to confirm balances or offer to ACH funds into their new accounts.

Checking

Want to offer a checking account? Skip searching for a banking partner to hold the funds and allow you to onboard customers. These APIs enable you to skip the partnership and plumbing legwork.

Credit Cards

Perhaps you’ve got a spin on the traditional credit card and think you can get into the flow of interchange fees. Maybe a card for teens or one to control your spending?Avoid the upfront fees and convincing card issuing partners and use one of these APIs instead.

Trading Equities

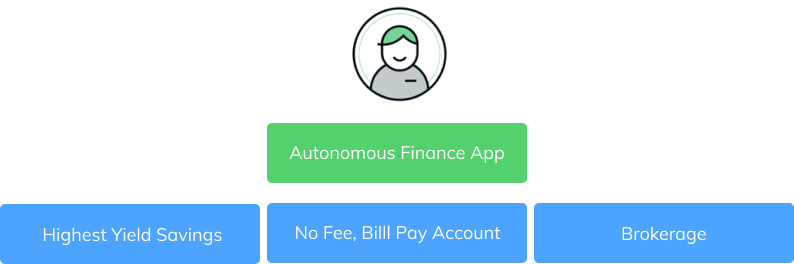

Now that you’ve got millions of people direct depositing their paychecks and spending using your credit card, let’s offer them some investment tools to put their money to work. Sure, they could open an E-Trade account, but wouldn’t it be easier to do this in the same account they already use for their personal finances? You could start the multi-month, multi hundred thousand dollar process to launch a Broker-Dealer, or leverage one these APIs to get started immediate.

These APIs are serving as the infrastructure anybody needs to get finance products to market quickly. The end result will be more products tailored to more market segments and hopefully better finance experiences and outcomes for all of us.